Track Wash Sales Across All Investment Accounts.

Easily monitor and identify wash sales across all your investment accounts, ensuring compliance and optimizing your tax strategy.

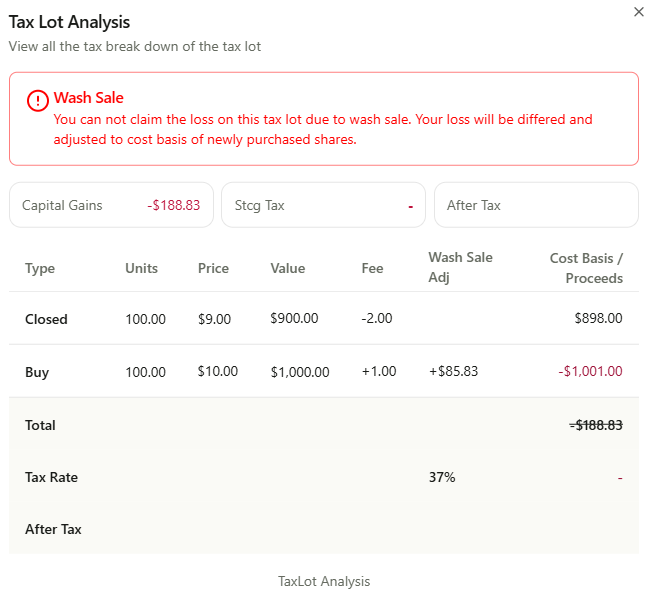

Wash Sales

Wash sales can be a major headache for investors, and many brokers won't alert you during trades or limited to that specific account. Our tool helps you track and monitor wash sales across all your investment accounts, including 401(k)s. With our simple analysis, you can easily avoid wash sales and optimize your tax strategy.

Wash Sale Deduction

Wash Sale Deduction Help you to warn you that you cannot claim the loss on the sale of a security if you buy a substantially identical security within 30 days before or after the sale.

Potential WashSale

Get proactive alerts about potential future wash sales, helping you stay ahead and optimize your tax strategy.

| Ticker | Close Date | Total Book Gain Loss | Holding Period |

|---|---|---|---|

| SPY | 11/21/2024 | -$200 | 13 days |